Explore web search results related to this domain and discover relevant information.

The cash application process is one of the most critical functions of finance teams. Correctly applying incoming payments to customer invoices ensures accurate AR ledgers, faster liquidity, and reduced operational risk.

Emagia offers a comprehensive cash application platform that leverages AI, RPA, and OCR to accelerate payment matching and streamline AR workflows. Here’s how Emagia empowers finance teams: Faster Cash Flow: Automation reduces processing time, allowing funds to be available sooner.Cash application automation uses AI, RPA, and OCR technologies to match payments to invoices automatically, reducing errors and accelerating cash flow. AI analyzes historical payment patterns, predicts exceptions, and intelligently allocates payments, improving match rates and reducing manual intervention. Benefits include faster cash flow, improved match rates, reduced DSO, fewer manual errors, enhanced compliance, and better customer satisfaction.In today’s fast-paced business environment, cash application automation is key to improving accounts receivable efficiency, accelerating payment matching, and achieving faster cash flow.By automating payment matching and posting, businesses can accelerate the cash conversion cycle. Digital cash posting ensures that funds are available faster, reducing the time cash sits in transit.

By adopting accounts receivable cash posting acceleration strategies, organizations can streamline the cash application process, minimize errors, and gain real-time visibility into their receivables. Faster cash posting also improves financial reporting accuracy and strengthens overall cash ...

By adopting accounts receivable cash posting acceleration strategies, organizations can streamline the cash application process, minimize errors, and gain real-time visibility into their receivables. Faster cash posting also improves financial reporting accuracy and strengthens overall cash management.Cash posting refers to the process of applying incoming payments to the corresponding invoices in a company’s accounting system. Efficient cash posting ensures that payments are matched correctly, disputes are minimized, and financial statements reflect accurate balances. Faster cash posting reduces the time between receiving aAutomated cash posting software helps match incoming payments to invoices quickly and accurately. Features such as rule-based payment matching, intelligent remittance data extraction, and exception handling streamline the cash application workflow, ensuring faster processing.Speeding up cash posting offers multiple benefits: improved cash flow, reduced DSO, enhanced financial reporting accuracy, minimized errors, and increased efficiency in accounts receivable operations. Faster posting also strengthens relationships with customers by providing transparency and timely account updates.

Top 10 Best Fast Cash Loans in Manhattan, NY - July 2025 - Yelp - efundex, Chase Bank, Queens County Savings Bank, Bad Credit Payday Loans, Self Reliance NY Federal Credit Union, Brooklyn Cooperative Federal Credit Union, Capital One Café, World Business Lenders, Wells Fargo Bank, Flushing Bank

See more fast cash loans in Manhattan.

Increasing your cash flow can free up more money to pay off debt. Here's how to increase cash flow for debt repayment so you can focus on other financial goals.

If high interest rates are inflating your payments, lowering them can improve cash flow and help you pay down the principal faster. For instance, you could consolidate multiple debts with a personal loan, which often has lower rates than credit cards.A budget gives you a clear snapshot of how much you have available to spend on various monthly expenses and how much money you have leftover. If you’re struggling to increase cash flow, having a clear and reliable budget will allow you to identify which spending categories can be cut back.If you’re struggling financially, ask lenders about hardship programs. They may agree to temporarily reduce your payments or interest rates, which can free up cash in the short term to aggressively pay down your debt.For example, say you get paid on the 1st and 15th of every month, but your loan and credit card bills aren’t due until the last week of the month. That means you may have little cash leftover to put toward extra debt payments once all of your other bills are paid.

Discover the root causes of slow cash application and learn proven strategies to accelerate payment matching with automation. Improve accuracy, reduce manual work, and enhance your accounts receivable process for faster cash flow and better financial control.

After identifying the root causes of slow cash application, the next step is implementing solutions that streamline the process, reduce errors, and improve collections efficiency. Automation, AI-powered tools, and workflow optimization can significantly reduce manual intervention, helping organizations post payments faster and accurately.This approach reduces manual cash application challenges and increases overall collections productivity. RPA handles repetitive, rule-based tasks such as payment posting, remittance retrieval, and exception handling. By automating these processes, companies can reduce operational bottlenecks and improve AR workflow efficiency. RPA also minimizes human error and ensures consistent application of business rules, contributing to faster cash posting.Centralized dashboards also help forecast cash flow and improve AR efficiency. Digital tools such as self-service portals, automated dunning emails, and smart reminders streamline communication with customers. These tools reduce the need for manual collections, improve payment recovery rates, and enhance the customer experience. Digital engagement supports faster cash application and increases overall AR turnover.Short pays, deductions, and partial payments can delay cash application. Automation and AI tools automatically flag these exceptions, assign them to the right team members, and provide recommendations for resolution. This reduces manual effort and ensures faster resolution of cash application bottlenecks.

Quick Cash Loans are crafted specifically for moments when you need financial support quickly. Whether it’s a special life event or an urgent expense, our Quick Cash Loans provide a fast solution (with no credit check requirement).

As a valued Mirastar Federal Credit Union member, our Quick Cash Loans serve as your go-to financial solution for life’s special moments, times of opportunity and urgent needs. From covering unexpected expenses to seizing new opportunities, you can count on us to be there for you.Late fee of 3% of the payment amount ($5.00 minimum) will be assessed if payment is not received within 10 days of due date. Rates and terms are subject to change without notice. The following restrictions apply: (1) Quick Cash Loan applications accepted online only.Whether you need extra cash for college, groceries, an emergency car repair, or anything in between, a Quick Cash Loan can help.Apply and get approved in under 60 seconds. It’s easy to apply for a Quick Cash Loan! You can borrow up to $2000 and get fast approval with no credit check required.

Are you trying to sell your house fast for cash in Louisville CO and want to avoid the stress, fees, and time involved in traditional home selling? Whether you’re relocating, downsizing, or just done with the DIY repairs, Red Crane Company offers a faster, easier path to selling your home.

Looking to sell your house fast for cash in Louisville CO? Red Crane Company offers as-is home sales, zero fees, and closings in as little as 7 days. Get started now!Red Crane Company – We Buy Houses – Sell Fast For Cash – Same Day Offer Need To Sell Your House Fast? Get your fair cash offer from Red Crane.That’s why more homeowners are turning to cash buyers. According to Zillow, a cash sale skips the financing process, reducing risk and cutting the timeline dramatically.And Clever Real Estate notes that Colorado sellers who go with cash buyers often close in 7–14 days—a massive time savings.

The cash outflow portion of the cash flow equation is just as important as the cash inflow side of the ledger. Higher net cash flow is the objective. You achieve that by increasing revenue, but simultaneously reducing unnecessary expenses will get you there faster.

Renegotiating contracts and supplier agreements: Vendors and suppliers face the same financial challenges your company does. That makes them more likely to accept changes to agreements if they improve their cash flow. One effective approach is to offer faster payment in exchange for a discount.Accounts receivable inflows must be in sync with accounts payable outflows. Delays or disruptions on either side will create cash flow problems. This can be addressed through invoice management. Use invoicing software for faster payments: Electronic invoicing can reduce payment times by up to 80% compared to paper invoices.Higher net cash flow can be achieved by increasing revenue, but simultaneously reducing unnecessary expenses will get you there faster.Struggling with cash flow? Discover practical strategies to improve your business’s financial health.

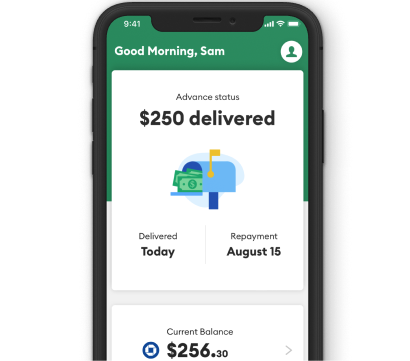

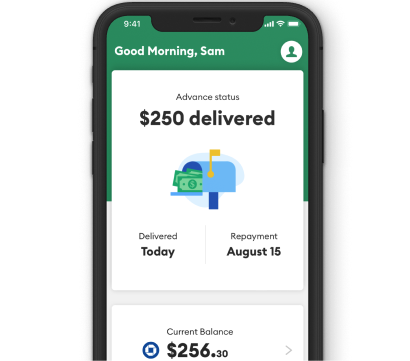

Get $25–$250 in minutes with Brigit's Instant Cash. No late fees. No tipping. No credit check. Join over 9 million users.

Your cash will be deposited into your bank account, so you can cover that unexpected bill or have cash on hand when you need it. To access it immediately, you will pay a small Express Delivery fee2. Otherwise, it will be delivered in 2-3 business days for no fee.The delivery time typically depends on your bank’s processing times. After an advance is requested, we cannot cancel or expedite the payment. 2. Express Delivery2—get cash within 20 minutes: With Express Delivery, you’ll receive your advance within 20 minutes.With Express Delivery, you can get your cash in minutes, for a small fee2.Once you’ve been approved for Instant Cash1, you can request an advance up to your approved amount directly in the app.

The rapper was just one month shy of completing his federal probation at the time of his death.

An instant cash advance app is typically the fastest method. Gerald offers instant transfers for users with supported banks, meaning the funds can be in your account in minutes, 24/7, without any extra fees. This is much faster than waiting for a traditional loan approval.

Need cash now? Learn how to get an emergency cash advance with no fees, interest, or credit checks. Gerald's BNPL + cash advance app can help.When unexpected expenses strike, the stress can be overwhelming. A sudden car repair, a medical bill, or an urgent home issue can leave you scrambling for funds. In these moments, you might find yourself searching for an immediate solution. Need an emergency cash advance?While many options exist, they often come with high fees and crippling interest rates. Fortunately, there's a better way. Gerald offers a unique approach that combines the flexibility of Buy Now, Pay Later (BNPL) with the support of a fee-free cash advance, helping you navigate financial hurdles without the extra cost.Before diving into the solutions, it's important to understand the basics. So, what is a cash advance? It's a short-term way to access cash, often used to cover expenses until your next paycheck. Many people wonder, is a cash advance a loan? While similar, they aren't exactly the same.

To get money quickly, you can sell your phone or gold, find a side hustle like driving for Uber, take out a loan or find ways to save.

A simple action like a phone call or internet search can save you money on bills, which may be faster than trying to earn more.Ask your employer for a cash advance on your pay. This usually doesn’t cost any fees and you can repay via payroll deduction. Some companies also offer low-cost loans to workers in crises. You also might consider EarnIn, a cash advance app that offers workers advances that they repay in a lump sum on payday at no interest.If you have life insurance that has cash value, sometimes called permanent life insurance, you can borrow against your life insurance policy and have the rest of your life to repay it. If you don’t repay, the insurance company subtracts the money from the policy payout when you die.Sometimes you need quick cash because payday is far away.

OnlyFans usage among college students surges as documentary filmmaker reveals normalization of the platform and concerning safety incidents for creators.

Rising college costs drive students to OnlyFans content creation, but experts warn of psychological impacts, safety risks and potential career consequences.A trend is sweeping college campuses nationwide as students head back to school while looking to make some extra cash.

Get money in minutes, build credit history and avoid hidden fees with Possible Finance. Apply in the app with just a few taps and manage money on your terms.

Everyone who uses Possible gets access to our benefits like rescheduling payments for up to 29 days from the originally scheduled date and building credit history. There’s no FICO check when you apply with Possible. Just link your bank account and we’ll review your transactions, income and cash flow to help you qualify—no matter your credit score.Quick cash for those moments you didn't see coming—enjoy months to repay with no hidden fees.

Personal loans can help consolidate debt or fund a major purchase. Apply online or personal loans of up to $20,000. Money as soon as 1 hour after loan signing.

When your immediate need for emergency cash starts calling, OneMain is in your corner. Apply for an emergency loan online and get money as fast as 1 hour after loan closing.

A supplier waiting on cash from overseas buyers may need to finance operations through expensive credit lines. Exporters might hesitate to expand into new geographies if it means tying up capital in slow-moving receivables. The friction distorts pricing, encourages conservative growth strategies, and can even exclude small firms from participating in global trade altogether. “The reality is that the world is moving way faster ...

A supplier waiting on cash from overseas buyers may need to finance operations through expensive credit lines. Exporters might hesitate to expand into new geographies if it means tying up capital in slow-moving receivables. The friction distorts pricing, encourages conservative growth strategies, and can even exclude small firms from participating in global trade altogether. “The reality is that the world is moving way faster than most companies can keep up pace with,” Wendy Tapia, head of product, receivables at FIS, told PYMNTS Wednesday (Sept.Companies are beginning to benchmark international expansion not just on projected revenues but on cash conversion cycles. A market that generates high sales but locks up capital for 90 days may ultimately be less attractive than one with lower volume but faster settlement.Cross-border B2B commerce will always involve complexity. However, in an era where speed and efficiency define competitive advantage, the companies that master time to cash won’t just move money faster but could rewrite the rules of global growth.Why Time to Cash Is New Benchmark for Cross-Border B2B Growth · Fifth Third Says $200 Million Loan Fraud Isolated Incident · Mastercard Introduces Tools to Facilitate AI-Powered Payments and Agentic Transactions ... See More In: B2B, B2B Payments, compliance, cross-border payments, faster payments, Global Payments, News, PYMNTS News

Get cash when you need it. With Dave, you could get ExtraCash™ up to $500 with no credit check, no interest, and no late fees. Qualify in 5 minutes or less.

A quick cash loan can help you out in a pinch if you need money for an emergency or another short-term need. Here are our top lender picks for quick loans.

But keep in mind that the shortest amount of time a lender says it can get approved funds to you often comes with a disclaimer. A number of factors can delay your funding, and depending on your bank, there may be a wait before you can access your cash.The most affordable quick cash loans are typically available for people with strong credit and a demonstrated ability to repay the loan — lenders may consider your income and assets while evaluating your application, for example. But even if your credit isn’t great, you’ll likely still have some options.To get a loan quickly, look for lenders that advertise “instant” or “same-day” funding. Certain factors, like what time of day you apply, whether you’re applying on a business day and when your bank accepts the funds into your account, may affect when you actually receive the cash.Lenders that offer prequalification are a good place to start — that’ll give you an idea of whether you’ll qualify with a lender before submitting a full application. Additionally, consider cash advance apps as a way to get money — these may not require a credit check.

Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store.

Nevada: The use of check-cashing services, deferred deposit loan services, high-interest loan services or title loan services should be used for short-term financial needs only and not as a long-term financial solution.Texas: Speedy Cash operates as a Registered Credit Access Business (CAB).Why Choose Speedy Cash for Personal Loans?∞Cash advances only available up to approved credit limit; some restrictions may apply.

Unexpected events can easily overwhelm your cash reserves, and you might need some fast cash.

With these loans, the pawn shop holds your item as collateral, and you’ll receive a cash amount for less than your item is worth. You’ll then receive a due date to repay the loan. If you fail to repay it, the pawn shop keeps your item.With CardCash, you can enter your gift card details on the site and receive a quote for your card. You won’t get the full amount for your card, but you may get up to 92 percent of its value. While it may take a few days to receive the funds, you’ll ultimately have cash on hand.You can also become a pet sitter on sites like TrustedHousesitters, where you can get paid to pet sit in more than 130 countries. Requesting long-term sitting jobs may let you experience life in a different country while making cash.You could benefit from debt consolidation if you have decent credit and several outstanding loans with high interest rates. Although you won’t earn money from this strategy, it can help reduce the amount you’re paying each month in interest, leaving you with additional cash flow.